When it comes to securing an auto loan or mortgage, your financial track record speaks volumes. Banks and lenders rely on your credit report to gauge your suitability as a borrower. By assessing the information within it and your financial past, they evaluate the likelihood of you repaying the funds they lend.

While most people are acquainted with the concept of a credit score, this number is a culmination of various data points derived from your past financial activities. It provides a quick overview of your financial position, yet it doesn’t reveal the complete narrative by itself.

Understanding the intricate details encompassed in your credit report holds significance for multiple reasons. It not only offers a nuanced perspective of how lenders perceive you but also serves as a guide for making sound financial choices.

Your credit report presents a comprehensive history of your credit cards, loans, and bills, highlighting how punctually you’ve made payments. Even if you believe your financial standing is robust, a pattern of tardy payments could adversely affect your ability to secure a new car loan or rent an apartment. Identifying such issues on your report provides an opportunity to rectify any lapses and enhance your creditworthiness.

There’s no concealing your financial history from credit providers. It’s imperative for everyone to be cognizant of what their credit reports convey about their financial responsibility and comprehend the potential consequences. For further insights, refer to the accompanying resource.

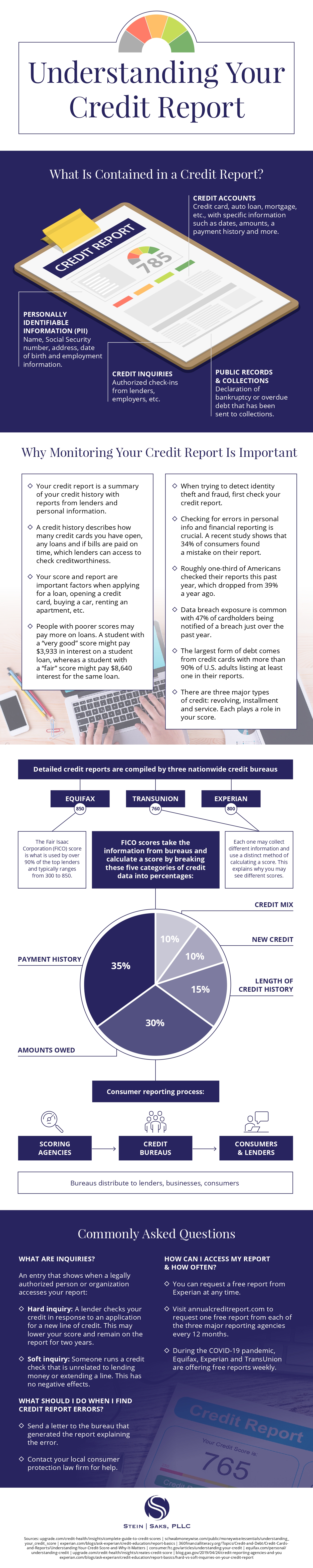

This infographic was created by Stein Saks, a credit reporting errors attorney